The 2022 BIR Tax Table: How Much Taxes You'll Need To Pay This Year

“The only two things certain in life are death and taxes,” goes the old saying, and as jobseekers and employees, we have to pay a share of our income to the Bureau of Internal Revenue (BIR), as well as expanded value added tax (E-VAT) on the things we buy.For employers and employees, most of their dealings with the BIR are related to income tax. Knowing what the BIR Tax Table is will help you manage your finances better. To make it easier for us to figure out how much to pay, the agency shares the current BIR Tax Table on its website as a reference for all taxpayers.

An agency attached to the Department of Finance, the BIR is responsible for more than half of the Philippine government’s revenues. Without the taxes collected by the BIR, the national government will most likely face bankruptcy in a matter of months.

Aside from the task of assessing and collecting all internal revenue taxes, fees, and charges from Filipinos, the Bureau is also responsible for enforcing penalties and fines on anyone caught violating tax-related laws and regulations, and administering and regulating the National Internal Revenue Code and other laws related to revenue and taxes.

Here are the BIR Tax Tables for 2022, and some points on income tax and other tax-related concerns that prospective and current employees should note.

The TIN

Before being employed, you need to secure a Tax Identification Number (TIN) from the BIR. Your first company usually helps you get one. Some points to know about it:

- Your TIN is yours for life.

- No one is allowed more than one TIN.

- Your TIN is unique and is not the same as anyone else’s in the country, alive or dead.

- Getting a TIN online is now possible through the BIR eRegistration System.

- Any person who secures more than one TIN shall be held criminally liable under Section 275 of the National Internal Revenue Code.

The Income Tax Return (ITR)

The following individuals and entities are required to file an ITR:

A. Individuals

- Resident citizens receiving income from sources within or outside the Philippines whose annual income exceeds PhP250,000

- Non-resident citizens receiving income from sources within the Philippines

- Aliens, whether resident or not, receiving income from sources within the Philippines

B. Corporations no matter how created or organized, including partnerships

C. Estates and trusts engaged in trade or business

What entities have the option not to file their ITR?

- Individuals whose gross income does not exceed their total personal and additional exemptions

- Individuals whose compensation income derived from one employer does not exceed PhP250,000 and the income tax on which has been correctly withheld as their companies file their ITR for them

- Individuals whose income has been subjected to final withholding tax, as their companies file their ITR on their behalf

- Those who are qualified under “substituted filing.”

Who are exempt from paying income tax?

- Individuals earning less than Php250,000 a year

- Non-resident citizens who have spent most of the taxable year outside the country or have established their intention of not residing in the Philippines

- Overseas Filipino workers (OFWs)

- Minimum wage earners

What forms are used when filing an annual ITR?

- BIR Form 1700: Used by individuals earning compensation income, including non-business-/non-profession-related income; companies use this for most of their employees

- BIR Form 1701: Used by self-employed individuals, estates, and trusts, including those with both business and compensation income. Freelancers and home-based employees fall under this category.

- BIR Form 1702: Corporations and partnerships

How do you file an ITR?

Employees using BIR Form 1700 are usually assisted by their employers in filing their ITRs. The following steps are helpful for those using BIR Forms 1701 and 1702:

- Fill up the appropriate BIR Form in triplicate.

- Attach the corresponding documentary requirements.

- If a payment has to be made, proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District Office (RDO) where you are registered and present the duly accomplished BIR Form with the required attachments and your payment.

- In places where there are no AABs, proceed to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer located within the RDO where you are registered and present the duly accomplished BIR Form with the required attachments and your payment.

- Receive your copy of the duly stamped and validated form from the teller of the AABs/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

For “No Payment” returns, including refundable returns, and for tax returns qualified for second installment:

- Proceed to the RDO where you are registered or to any Tax Filing Center established by the BIR and present the duly accomplished BIR Form with the required attachments.

- Receive your copy of the duly stamped and validated form from the RDO/Tax Filing Center representative.

The Taxes

How is the tax you pay computed?

Unless you are self-employed, a business owner, or an accountant and HR practitioner, your taxes are most probably computed and paid for on your behalf by your employer (withholding tax).

How does your employer know how much to deduct from your salary to pay the BIR?

Step 1: Find out how much your taxable income is. This formula will tell you how much of your compensation is subject to tax:

Taxable income = (Monthly Basic Pay + Overtime Pay + Holiday Pay + Night Differential) – (SSS/PhilHealth/Pag-IBIG deductions – Tardiness – Absences)

Find out how much you need to contribute for the following:

- SSS contribution (Click here to view SSS contribution table)

- PhilHealth contribution

- Pag-IBIG/HMDF contribution: P100 (constant, as the other PhP100 is paid by the employer)

Step 2: Use the BIR tax table to compute your taxes.

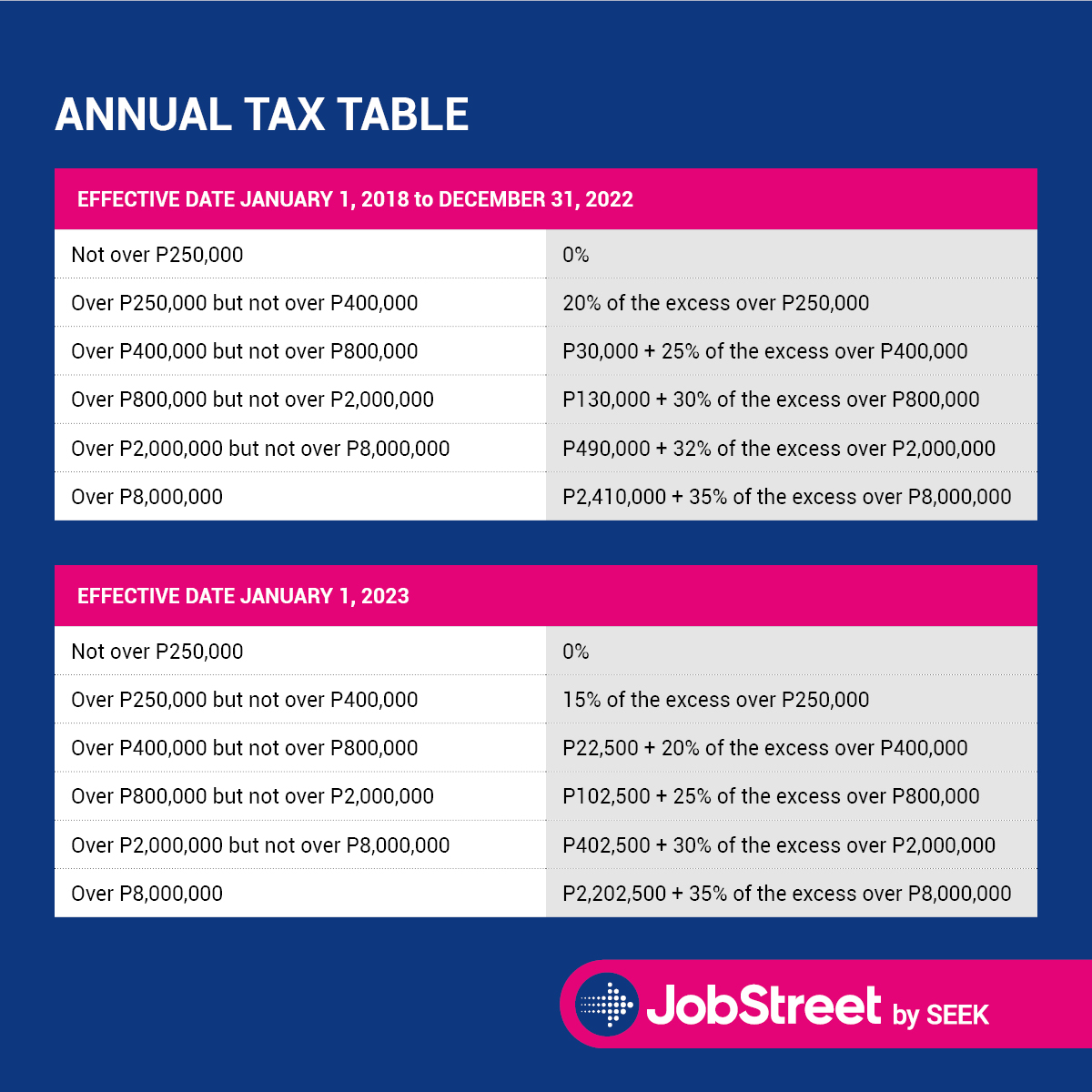

It might not be known to many, but the Tax Reform for Acceleration and Inclusion (TRAIN) Law or Republic Act No. 10963 was implemented to restructure and simplify tax compliance and reduce the taxes paid by employees earning under a certain amount.

Under the TRAIN Law, individuals earning less than Php250,000 per year are exempted from paying income tax, while those earning more than Php8 million a year will pay Php2.41 million plus 35% on the excess over Php 8 million.

There is a BIR Tax Table that is now in use from Jan. 1, 2018 until the end of 2022, and another that will be applied effective Jan. 1, 2023.

There are two types of BIR tax tables – the annual tax table and the withholding tax table.

- BIR annual tax table: gives all income earners a general view of how much taxes they have to pay on their annual income.

- BIR withholding tax table: shows how much tax shall be withheld by employers from their employees’ compensation.

The withholding tax tables show six columns for every pay period. Under the columns are the compensation ranges and their corresponding tax rates. Your tax rate goes up as your taxable income increases.

What should you be earning? Find out in our Salary Guide.

Other Tax-Related Concerns

How often are taxes deducted from my salary?

Most employers in the Philippines pay their employees twice a month – every two weeks. Some deduct the entire tax payable on one payday and deduct the other government deductibles (e.g., PhilHealth, SSS, etc.) on the other payday, while other employers divide everything equally between the two paydays.

Is the 13th-month pay taxable?

The 13th-month pay is subject to tax if the amount exceeds Php 90,000. But if the amount is less than Php 90,000, the employee gets to keep it tax-free.

What are ‘tax refund’ and ‘tax deficiency’?

When errors in computation occur, over-withholding or under-withholding of employees’ income tax on compensation may happen. If the former, you get a tax refund. If the latter, then you have a tax deficiency and may have to pay an additional amount for tax, usually at the start of the year.

Keep updated on the BIR Tax Table!

Laws and regulations on taxes may change, so keep yourself updated on the latest by visiting the BIR website. Jobstreet also regularly updates its articles to give you useful information related to workplace matters.

Find your new dream job on Jobstreet. #LetsGetToWork by creating or updating your profile. For more jobs, visit JobStreet or download the JobStreet app on Google Play or the App Store.